Press Release

By U.S. Rep. Matt Gaetz, 2-3-24

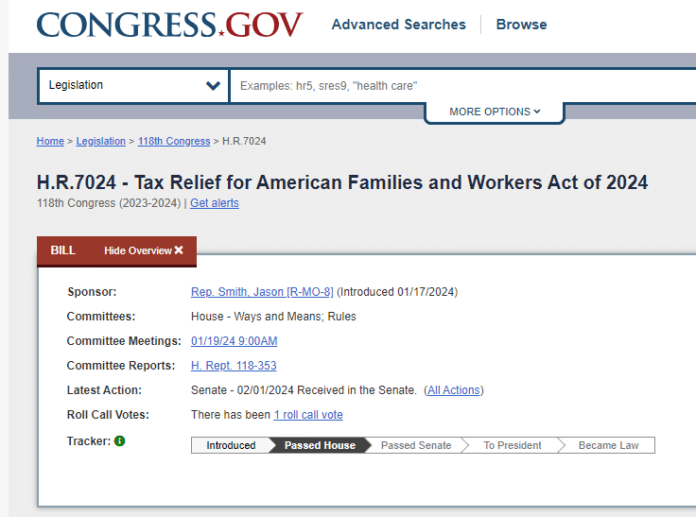

| Excerpt from Congressman Matt Gaetz’ 2/2/24 Newsletter (Thanks to Deb Boelkes of We The People): Update on HR 7024– On Wednesday, the House considered a tax package consisting of an expansion of the Child Tax Credit (CTC) and an extension of certain business-tax provisions. While H.R. 7024, the “Tax Relief for American Families and Workers Act of 2024,” was sold by its architects as tax relief, in reality, it is a welfare bill masquerading as a tax bill. For this reason, I was one of 47 Republicans to vote against it. In the name of bipartisanship, Republican leadership cut a deal with Democratic leadership to boost the refundability of the CTC in exchange for tax cuts for businesses. Some of the business provisions I support; however, I could not support providing refundable tax credits in the form of checks to people who have not paid taxes. This simply is not tax relief—it is welfare. Making matters worse, the bill continues the policy of not requiring the tax filer to provide a Social Security number to claim the CTC. A Social Security number is only required for the child the tax filer is claiming; accordingly, illegal immigrants, whose numbers only continue to increase under President Biden’s open-border policies, will be able to receive checks if they have children born in the U.S. This will end up being a massive pull factor to bring people into this country illegally. Compounding the problem with this bill is a side deal that was made with New York House Republicans to bring a bill to the House floor next week to increase the cap on the State and Local Tax (SALT) deduction. The SALT deduction is provided to taxpayers who live in states with high state and local taxes. I am opposed to the SALT deduction in principle because taxpayers in low-tax states are forced to subsidize taxpayers in high-tax states, like New York and California. Therefore, I have urged my fellow Florida representatives to reject any SALT legislation. |