Opinion

By Steve Nicklas, 5-6-24

If Joe Biden is re-elected this fall, he’ll give everyone a big gift. It’s a tax increase bigger than the World Trade Center.

In an unconventional manner, Biden is campaigning on massive tax hikes. Most politicians downplay such intentions. But there’s nothing conventional about Biden’s pro-woke administration.

“It (new taxes) never makes sense in any given year,” says Michael Seifert, the CEO of patriotism-rooted Public Square. “But it especially doesn’t make sense in an election year. That’s the most shocking element to all of this.”

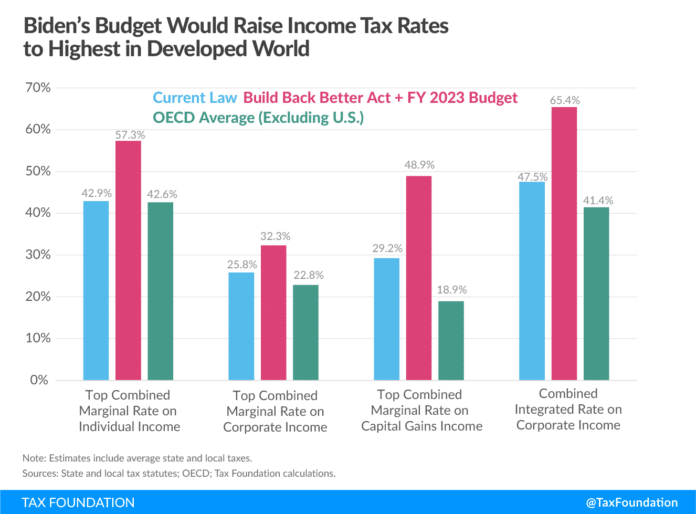

For beginners, Biden would let the Trump tax cuts expire in 2025. In a low voice, Biden leans forward and whispers, “They’ll stay expired.” Under Biden’s plan, the highest federal income-tax bracket would reach 44.6 percent.

Next, Biden wants to raise the capital-gains rate, also to 44.6 percent. This would be the highest ever. And the rate is almost double of what China imposes.

These moves would chill the U.S. real estate and stock markets like a gust of Arctic air. And scare away investors, who fuel our capitalist economy. Of course, the composition of the U.S. House and Senate would impact Biden’s plans.

These new federal taxes would be compounded by what cities and states assess. The combined income-tax rate could reach 50 percent in some places, like in New York City. Meanwhile, Americans are already enduring massive price increases through the ravages of inflation.

“You do not hike taxes in a recessionary time in order to spur growth in the economy,” says Seifer. “It’s backwards. This is the opposite of what the government should be doing.”

Biden and Treasury Secretary Janet Yellen have even more in their globalist grab bag. A two-percent wealth tax on the wealthy is also being considered, along with a minimum tax on U.S. corporations.

In tandem with an exorbitant capital-gains rate, these tax-the-rich schemes make respected financial commentator Larry Kudlow cringe. The rich already pay most of the taxes in the U.S. Yet Biden believes there are still inequities.

“There’s too much racial inequality?” Kudlow asks sarcastically. “So we’re going to penalize the people who have the most assets – which are white people. DEI strikes again.”

The Biden administration has even hinted at taxing unrealized gains in investments. This would compound the chaos.

“Instead of a rising tide lifts all boats,” Kudlow says, “we’re going to have a falling tide that sinks all boats.”

Yellen is talking with leaders of the G-20 countries about instituting the two-percent wealth tax, across the globe. “Of course, the United States has the most wealth, so we would be hurt the most,” Kudlow says. “This will do enormous damage to the U.S. economy.”

The wealthy would report their assets to a central government entity each year, something like the European Union. A similar process would be used to determine the minimum tax for corporations. The reporting processes would be cumbersome and intrusive.

“So we would be governed by foreign governments, particularly in Europe, who would then tax U.S. corporations here in America,” Kudlow says. “We’re even going to lose our sovereignty on taxes.” Our nation’s sovereignty has already been compromised with our open borders.

In all, Kudlow figures the multi-pronged tax increases could tally $5 trillion. “You can’t make this stuff up,” Kudlow says. “It’s absolutely insane.”

Former president Donald Trump has likewise criticized Biden’s proposals. As the U.S. economy slows, Trump doesn’t prescribe more taxes – money taken from the private sector and given to the public sector (i.e., government).

Trump is running on a conservative platform of lower taxes and less regulation – while scaling back the enormous federal government. This approach would help the economy and all taxpayers, from lower to upper classes. As well as U.S. companies, big and small. It’s polar opposite to Biden’s campaign.

“When I’m in the White House,” Trump says, “the Biden economic bust will quickly be replaced by the Trump economic boom.”

Now that would be a true gift, for all of us.

Steve Nicklas is the managing partner of Nicklas Wealth Management in Fernandina Beach. He is also an award-winning columnist. His columns appear in weekly newspapers in Northeast Florida and in Southeast Georgia, and on his website at www.SteveNicklasMarketplace.com. He has published a book, “All About Money,” of his favorite columns from the past 20 years. The book is available on Amazon. He has also done financial reports for area radio stations and for National Public Radio in Jacksonville. He can be reached by email at [email protected] or by phone at 904-753-0236.

The views expressed in this commentary are those of the author and do not necessarily reflect the official position of Citizens Journal Florida