Opinion

By David Stockman, David Stockman’s Contra Corner, Lew Rockwell

10/27/25

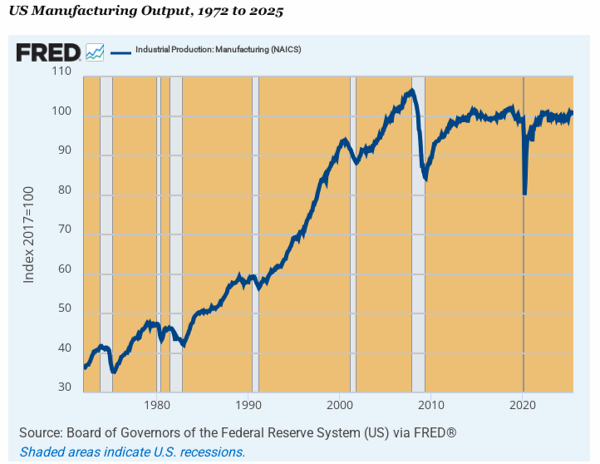

You can bet the 12 purported geniuses on the FOMC have never looked at the graph below.

It shows that for all their wild-ass money printing in recent years, the US index of manufacturing output stands at 101.39, which is nearly 5% below the level reached on the eve of the financial crisis in December 2007.

That’s right. The US manufacturing economy has been shrinking in real physical terms for the past 18 years, notwithstanding the fact that during that interval the Fed has printed nearly $6 trillion in brand, spanking new money that it snatched from thin air.

So something big and bad happened after the Fed went all in on money-printing in response to the stock market meltdown in the fall of 2008. After all, during the 28 years between 1972 and 2000 the very opposite occurred. Manufacturing output in the US rose by nearly 150%, which translates to a 3.3% growth rate per annum.

Yet there is no mystery as to why manufacturing output abruptly went flatter than a board after the Financial Crisis. To wit, the mad money-printers in the Eccles Building simply inflated the bejesus out of the US economy at a time when what was urgently needed was a stern deflation of an already inflation-bloated industrial sector.

Read the full article here: https://www.lewrockwell.com/2025/10/david-stockman/how-the-feds-money-printing-broke-american-industry-and-what-comes-next/

The views expressed in this commentary are those of the author and do not necessarily reflect the official position of Citizens Journal Florida