Opinion

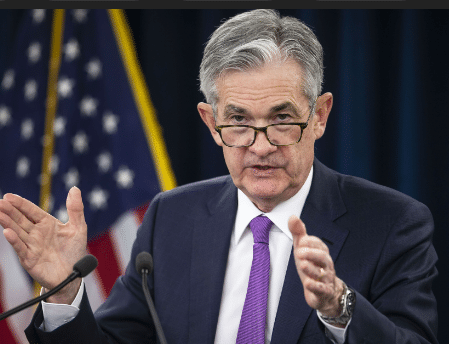

By Alex J. Pollock, NY The Sun

04-24-24

Meantime the central bank seeks to palm off on the public the idea that its staggering negative capital is a ‘deferred asset.’

Hold up your hand if you think that the aggregate losses of an organization are an asset of that organization. No hands at all? Absolutely right. Losses are not an asset. That’s accounting 101. Yet the greatest central bank in the world, the Federal Reserve, insists on claiming that its continuing losses, which have accumulated to the staggering sum of $164 billion, are an accounting asset.

The Fed seeks to palm off this accounting entry as a “Deferred Asset.” Why does the Fed do this, which perhaps makes it look tricky instead of majestic? Because it does not want to report that it has lost all its $43 billion in capital and now has negative capital. The inevitable arithmetic is plain: start with the Fed’s $43 billion in capital, lose $164 billion, and the capital has inescapably become negative $121 billion.

The Fed is not pleased with this answer. In addition to its “Deferred Asset” gambit, it frequently and publicly asserts that negative capital does not matter if you are a money-printing central bank. The idea seems to be that a central bank can always print up more money. The Fed further declares that it is not in business to maximize profits. Even were all this true, it fails to change the correct capital number: negative $121 billion.

Read the full article here: Federal Reserve’s Capital Has Now Plummeted to Negative $121 Billion, and Congress Needs To Act | The New York Sun (nysun.com)

The views expressed in this commentary are those of the author and do not necessarily reflect the official position of Citizens Journal Florida