Opinion

By Jeff Childers

10/10/25

Good morning, C&C, it’s Friday! I have a quick roundup for you this morning, which seems unfair given how much is happening this week. But it’s good stuff. In today’s post: the second Trump 2.0 indictment drops, and while the target is a deeply unserious person, it is still extremely satisfying; former FBI Director and all-around unpleasant person James Comey arraigned; gold hits historic high price and seems bound to keep going; we sprint past black pillers and connect dots from gold to good news; and the most marvelous elections security news yet begins setting the table for next year’s midterms.

🌍 WORLD NEWS AND COMMENTARY 🌍

🥬🥬🥬🥬

Yesterday, Democrats and their media allies bravely soldiered through a nearly unendurable news cycle, apparently having been ordered not to appear completely unhinged and competely unserious about their Palestinian preoccupation. So they were forced to cough up praises for President Trump over his Gaza peace plan. WaPo op-ed, yesterday:

Don’t get used to it. Things should be back to normal by the time you finish your breakfast eggs and chicken sausage.

In fact, by mid-afternoon yesterday, the progressive outrage machine had begun shuddering back to life and belching black smoke again, as the next indictment story dropped. Politico headlined it: “Letitia James pursued Trump. Then she was indicted.”

Long before New York Attorney General Letitia James “pursued” Trump, and long before she had any idea what Trump might have done wrong, Mx. James promised progressive voters to find something—anything!. That’s why Politico’s headline earned four cabbages on C&C’s “journalistic malpractice” scale.

The accurate headline should have been, “First Letitia James ran on Getting Trump. Then she was indicted.”

In her delirious 2018 election night victory speech, Mx. James put an exclamation point on her get-Trump pledge, promising not to stop looking until she found a crime: “As the next attorney general of his home state, I will be shining a bright light into every dark corner of Trump’s real estate dealings.”

It took a while, but she finally found one. With enthusiastic assistance from corpselike judge Arthur Engoran, Mx. James obtained a record-smashing half-billion-dollar fine in a highly technical case with no identified victims and extremely debatable real estate valuations.

Anyway, New York’s appalled Court of Appeals promptly scratched the fine, as every lawyer not taking antipsychotics had predicted would happen. BBC:

Though stubbornly continuing to claim victory, Mx. James has appealed the decision to New York’s high court, which is expected to promptly render its decision sometime in early 2037. Anyway, the point is, after all that falderol, James’s historic fine was erased like a child’s sand drawing of a Falstaffian DA washed away by the incoming tides.

While the total spent is not yet known for certain, New York’s legislature reportedly budgeted $10 million taxpayer dollars to James’ get-Trump case. She recovered zero dollars in fines, and Trump got elected anyway. So.

New Yorkers, I hope it was worth it.

🥬 Yesterday, the Department of Justice issued its criminal indictment of Mx. James for mortgage fraud. It is a simple, one-count charge. Unlike James’ case against Trump, it is based on straightforward law. It is neither novel nor creative. Many ordinary Americans have been convicted for doing the exact same thing.

The short indictment alleges that James obtained a mortgage on a small house. She confirmed in writing —under penalty of perjury, on multiple forms— that it was a personal residence and definitely not a rental, thereby obtaining a lower interest rate on her mortgage. But then she regularly reported rental income from the property on her tax returns anyway.

It’s not a lot of money, not relative to the Trump case, anyway. Over the 30-year life of the loan, James only stood to benefit by about $20,000 dollars.

But it’s enough.

Nearly all lawyers who’ve examined it, including TDS-infected ones, have concluded that, unless the DOJ has its facts wrong, the DOJ has the Trump-prosecuting DA dead to rights. Open and shut. Do not pass go.

(Haha, for once, Politico’s article did not quote any legal experts, only politicians, which should have earned it another cabbage, but I’m too lazy to go back and add one. Just imagine it.)

🥬 James now faces a maximum penalty for federal bank fraud (18 U.S.C. § 1344) and making false statements to a financial institution (18 U.S.C. § 1014) of up to 30 years in prison and up to $1 million in fines. She is also subject to possible forfeiture of any “improperly gained” assets— presumably the house. (The DOJ helpfully included a forfeiture notice in the indictment.)

Ironically, James tried to forfeit all of Trump’s New York assets.

Assuming she is convicted, James’ sentence will be decided by Judge Jamar Walker (Biden, 2022). Judge Walker, 37, has been described as Virginia’s “first openly gay federal judge.” On the other hand, before taking the bench, Walker was a federal prosecutor specializing in financial and public corruption crimes. So.

Ironically, in a video statement yesterday, James claimed that her indictment was just “weaponization of the justice system” and a “blatant perversion of the system of justice.” General BlueSky opinion didn’t seem to think she was innocent, not exactly, but they weren’t happy either:

Letitia James is the second domino. She’s now set for her arraignment (which is when a defendant enters a plea) on October 24th.

🔥 Also this week, human serpent and former FBI Director James Comey was arraigned. He pleaded “not guilty.” CBS:

Comey broke tradition and demanded a speedy trial —his constitutional right— and his judge speedily set trial for January 5th. It’s a bold and unusual move that pressures both the DOJ’s and his own lawyers.

Nearly every criminal defendant (99%+) waives their right to a speedy trial. On balance, I think it was a good move, but it also means less time for Comey to try to dismiss the case (he’s mentioned scads of reasons) or to try to disqualify the prosecutor, Lindsay Halligan. There’s only so much his lawyers can do at one time, and they must also now prepare for his trial during the worst time of year: the holidays.

All signs point to even more indictments coming down the pipeline, and I anticipate having to track a dizzying array of cases comparable to the peak of the Trump lawfare days.

How many indictments will it take to satisfy the “arrests now!” crowd?

📈📈📈

I’m a lawyer, not a financial advisor, but let’s talk about gold! Yesterday, Newsweek ran a darkly apocalyptic story headlined, “As Gold Hits New Record, Some See Warning Signs of Civilizational Collapse.” Oh, no! But … is it a mysterious and alarming sign of civilizational collapse? Or could it be something super terrific? Let’s play connect the dots.

For certain, the “buy gold” crowd is enjoying a moment. (For me, you can chalk this up with bitcoin. I always seem to show up late for the gravy train.) Ten years ago in December, 2015, gold sold for just $1,500 an ounce. This week, for the first time in history, gold surged to almost $4,100, before settling back just over the $4,000 mark.

You’d think this amazing investment opportunity would be a good thing, but as the Newsweek headline suggested, people are freaking out.

“We’re witnessing what may be one of the great pivotal moments in financial history, yet it’s being barely discussed,” said French financial influencer Arnaud Bertrand. He compared this week’s gold activity to other mild historical speed bumps like “The fall of Rome, Spain’s imperial decline, the French Revolution, and the end of Bretton Woods.”

Mike Duncan, host of The History of Rome and Revolutions podcasts, rhetorically asked Rolling Stone: “Is this thing pushing itself toward some sort of terminal failure? Yeah, it sure feels like it.”

Newsweek rounded up a parade of doom prophets who sounded more like Revelation than Bloomberg. It wasn’t just Newsweek, either, not even close. Two days ago, the UK Economic Times ran this eye-watering headline:

Economist and gold advocate Peter Schiff told the Times he thinks gold is nowhere near its peak, because the metal’s price “simply reflects the collapse of currencies.” Schiff is a grim outlier. Mainstream pundits predict a less astronomical price of “only” around $6,000 an ounce— still an absurd climb from Biden-era levels.

Silver has also surged, speeding across an already historical price point of $40 this month without even glancing in the rearview mirror (it’s now over $50). Cue the smell of burned rubber.

📈 Conspiracy theorists see the surge in precious metal prices as a sign of deliberate hyperinflation, designed by the government to crash the dollar and usher in an age of Central Bank Digital Currency; you know, to “save the day.”

The main problem with this particular dark conspiracy is that prices of other goods — tacos, gasoline, Big Macs, used Hondas, shoelaces, wages, everything— are not also spiking like precious metals. So, there’s no sign of hyperinflation yet. It is possible that precious metals are leading indicators, true.

But it is also possible that, in this case, metallic inflation is following something rather than leading anything.

📈 Since around 1980, when gold had its first big run, gold seems to have stuck below an invisible ceiling around $2,700. Silver has been even more controlled, stubbornly sticking around $30 an ounce. During the Biden era, gold and silver wedged into a historically tight range; between $1,800 and $2,700 for gold, and between $25 and $32 for silver.

That precious metal price discipline during the Biden era was most surprising because Biden tripled the supply of dollars— and the price of everything else skyrocketed. Economists —then completely unworried— called metal prices “range-bound.” But that was totally unnatural.

In previous inflation cycles —like the 1970s and the early 2000s— precious metals moved first and fastest. But during Bidenflation, they seemed downright sedated.

Also during Biden, there was a poorly reported but profoundly disquieting phenomenon of foreign central banks buying bullion like there was no tomorrow. According to the World Gold Council, 2022 and 2023 saw record-breaking official purchases — the fastest accumulation of gold reserves in modern history. China, Russia, India, Turkey, and Saudi Arabia grabbed gold, among others. Jerusalem Post, November 2024:

They were all buying gold like it was a once-in-a-lifetime opportunity.

Maybe it was. What if, for political cover against accusations about inflation —which Biden denied was happening at all— the US government manipulated the metals markets? That would explain both why metal prices remained stable while the cost of everything else increased, and why other countries were buying so much of it: by keeping the prices artificially low, Biden was basically giving it away.

That’s not a tinfoil helmet conspiracy theory. There’s a long, well-documented tradition of governments intervening overtly and covertly in commodity and currency markets when it suited their fiscal or political needs. Indeed, before Bretton Woods, the price of gold was artificially kept at $35 an ounce worldwide and everybody knew it.

During and after the 2008 financial crisis, Western central banks quietly lent and swapped bullion through ‘bullion banks’ to create a synthetic supply. Analysts complained this kept spot prices artificially low while balance sheets ballooned.

So what if —and this is what I think must have happened— Trump discovered Biden’s covert gold stabilization program and pulled the plug? Let see if any we can connect any dots.

Remember when, early this year, Trump was noisily threatening to audit Fort Knox? And then the story magically disappeared, nevermore to be seen? E.g., Business Insider, February 20th:

It wasn’t just a rhetorical question. Around the same time, an idea floated through the trade press —I covered it— that the US could massively increase its financial stability or create a sovereign wealth fund simply, by re-pricing its own gold at current market rates. Substack post from the Gold Observer, February 15th:

Gold Observer reminded us that on February 3, 2025, President Trump signed an executive order requiring a sovereign wealth fund be created within one year. Standing right next to him when he signed the order was Treasury Secretary Scott Bessent, who told reporters, “We’re going to monetize the asset side of the U.S. balance sheet for the American people.”

What asset?

One asset that America owns is 8,100 tons of gold (262 million ounces) — officially valued at only $42.22 an ounce, a 1973 accounting relic. Twice before, the US has repriced its gold to instantly create new wealth: once in 1972 when the official gold price was raised from $35 to $38, and again in 1973 from $38 to $42.22 an ounce.

📈 Let’s pull all this together. If Trump does intend to reprice US gold reserves to accurately reflect our true wealth, why would he do it at an artificially low Biden level? Surely he would let the price of bullion off the leash, allowing it to rise to properly reflect all the inflation that Biden had already created?

And only then —once the true, inflation-adjusted price of gold was set— reprice our gold.

In other words, it would be stupid to reprice gold at an artificially low level when a much better market price is sitting right in front of you. Why give away value that’s already yours?

For years, while Washington denied inflation and quietly stabilized gold, foreign central banks were the ones cashing in— buying American bullion on the cheap, storing the real wealth offshore, and leaving U.S. taxpayers holding the empty bag. Repricing gold at today’s market rate wouldn’t just acknowledge inflation; it would end another foreign subsidy.

America first.

Letting gold float freely, then marking it on the national balance sheet to that honest price, would flip the trade: the U.S. would capture the windfall instead of exporting it. The flow of gold would reverse, foreign vaults would stop filling, and for once, the balance of monetary power might tilt back toward the people who originally mined, minted, and defended it in the first place.

If the price does float to $6,000 an ounce (or more), and if Trump intelligently prices America’s hoard to that more rational market price, one single corrective accounting entry could instantly flood a sovereign wealth fund with $1.56 trillion dollars. That’s not stimulus, not borrowing, not money-printing — just marking reality to market.

Now imagine that happening early-to-mid next year, right before the midterm election season really gets underway. And then imagine that Trump says he needs a Republican supermajority in Congress to give all that value back to citizens in their new sovereign wealth fund?

Makes you think, doesn’t it?

🔥🔥🔥

Believe me when I tell you it’s getting hard to keep up with all the winning. The summer’s frenetic pace has done nothing but accelerate. I can only guess, but maybe it has something to do with all the early planning now beginning to bear fruit. Anyway, behold this astonishing Associated Press headline: “Former Republican election official buys Dominion Voting — a target of 2020 conspiracy theories.” And another puzzle piece just dropped into place.

As you read this next segment, remember how well and for how long we’ve all been taught that even questioning the legitimacy of electronic voting systems is tantamount to election denialism, which is the next worst crime after insurrection and asking questions about masks on Facebook.

Back in the spring, President Trump signed an executive order calling for sweeping voting reforms, including an auditable paper trail for all cast votes. Federal judges (of course) shut that right down, holding that states and Congress set election procedure, not the Executive Branch.

But two days ago, a newly formed company named Liberty Vote suddenly and unexpectedly announced it had bought electronic voting manufacturer Dominion and would move the headquarters from Canada to St. Louis. Liberty’s press release promised to restore trust to voting systems, reintroduce “hand-marked paper ballots,” and adjust company policies to follow Trump’s executive order on voting procedures.

Liberty is owned by former St. Louis elections director and Republican voting systems manufacturer Scott Leiendecker.

Leiendecker was the Republican election director for the St. Louis City Board of Election Commissioners from 2005 to 2012. He is also the founder and CEO of KNOWiNK, an non-partisan elections technology company based in St. Louis, which makes products like Poll Print and Poll Pad, used in polling sites across the United States.

Before his tech and business career, Leiendecker also worked for the Missouri Secretary of State as an election investigator, and has overseen international elections in difficult, war-tossed countries like Kosovo.

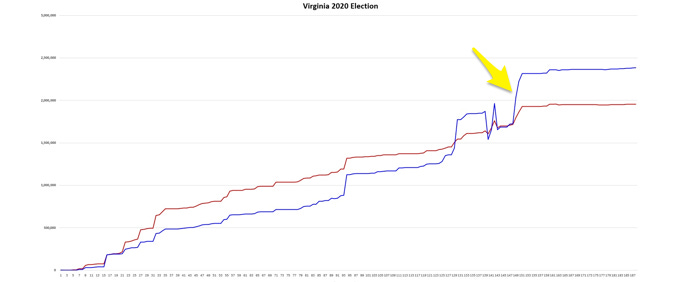

Corporate media claimed yesterday (without evidence) that Republican skepticism toward Dominion about “debunked” anomalies during the 2020 election destroyed the Dominion brand, making it “toxic” in red states and resulting in the sale. That’s possible.

You will be unsurprised by the BlueSky reaction. It was even more apocalyptic than the thought of gold hitting $100,000 an ounce. They are already denying the results of the next election:

Given that Dominion successfully sued several conservatives for defamation, progressives should be very careful about being too critical about Liberty Vote. All that celebrating over Dominion’s court wins could circle right back to lawsuits against liberals.

As they say, what’s good for the goose is good for the Trump-deranged gander.

We’ve discussed before what appears to be a significant, national strategy for not just for holding ground but sweeping the 2026 midterms. This acquisition of Dominion, well in advance of next year’s elections, is completely consistent with that theory.

Democrats have nothing comparable to show against this level of deep GOP organization. Their only focus seems to be keeping the government shut down and complaining about Trump’s latest mean tweet.

If I am right (and I think I am), things will just get better from here. I am feeling very optimistic. How about you?

Have a fantastic Friday! We’ll return tomorrow morning with a Weekend Edition roundup that will heroically try to capture all the week’s terrific and essential news, served with spicy commentary.

Don’t race off! We cannot do it alone. Consider joining up with C&C to help move the nation’s needle and change minds. I could sure use your help getting the truth out and spreading optimism and hope, if you can: ☕ Learn How to Get Involved 🦠

Twitter: jchilders98.

Truth Social: jchilders98.

MeWe: mewe.com/i/coffee_and_covid.

Telegram: t.me/coffeecovidnews

C&C Swag! www.shopcoffeeandcovid.com

The views expressed in this commentary are those of the author and do not necessarily reflect the official position of Citizens Journal Florida